The Value of a Creative Hire in Finance

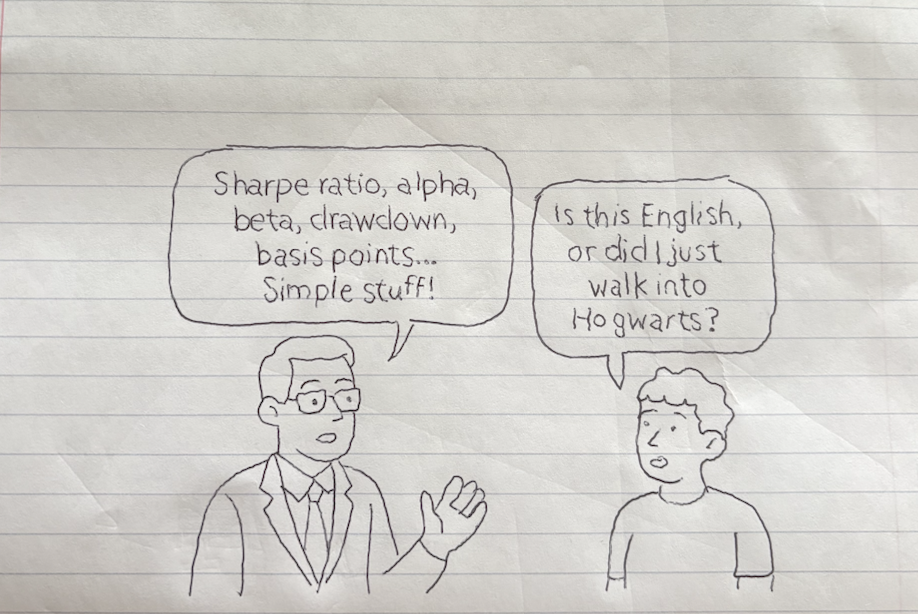

Your new creative hire walks into a meeting. They're the only ones in the room without a CFA designation. They can't rattle off the Sharpe ratio from memory. If you asked them to explain a basis point, they might pause.

But as the analysts debate decimal points and performance spreads, the creative’s focus shifts. They're not staring at the spreadsheets. They're watching the faces around the table.

They hear the hesitation in a client's voice. They notice the pride in a portfolio manager's story about their first big win. They catch the subtle ways people lean in or lean out when certain ideas are discussed.

While the rest of the room sees numbers, they see a narrative unfolding. Patterns not in the data, but in the emotions driving decisions.

That's the creative's gift.

This isn't a theory for me. It's something I've built my own team around. Some of the best hires I’ve made over the years didn't come from finance. They were writers, designers, storytellers, and brand builders. People who had never sat in on an investment committee meeting until they joined us.

And I did that on purpose.

Because I've seen firsthand that some of the best marketing ideas for boutique asset managers don't come from people who've spent their entire careers in the same echo chamber.

They come from individuals who can view the industry with a fresh set of eyes.

Who ask different questions.

Who bring ideas you'd never hear in a traditional finance conference room.

The Imposter Syndrome Is So Real

Imposter syndrome hit me on day three. I was on a client call, listening to talk about basis points and alpha generation, palms sweating.

I kept waiting for someone to say, "There's been a mistake. You don't belong here."

The voice in my head was relentless: You're not smart enough. You don't have an MBA. You've never worked at Goldman Sachs.

Here's what I've learned: imposter syndrome in finance isn't about not knowing enough. It's about thinking there's only one way to be smart. One way to add value. One acceptable background.

The turning point came in a pitch prep. While everyone else focused on numbers, I asked different questions: What's the story we're trying to tell? Who's our audience? How do we make them feel something, not just think something?

These weren't finance questions. They were human questions. And maybe that's exactly what we needed.

The creative brain that once made me feel like an outsider was actually my edge. While others saw data points, I saw narratives. Where they built arguments, I built connections.

I still have moments where the imposter syndrome creeps in. But now I see it as a sign I'm pushing boundaries. Bringing something new. Refusing to squeeze into someone else's definition of what belongs here.

Why Finance Needs More Than Math

Finance runs on precision. Facts. Accuracy. Measurable performance. Every decision is backed by data. Every decimal point matters.

Creativity runs on possibility. Vision. Connection. Emotion. Finding meaning in the messy. Seeing patterns no one else sees. Feeling what the data can't show.

For decades, these worlds stayed in separate lanes.

The industry is flooded with data. Every fund has performance charts, risk metrics, peer comparisons, and pages of disclosures. Everyone has the same jargon on their website.

When the data looks the same, why choose you?

It's the story that sets you apart. Because the way you make someone feel about the numbers—that's the real competitive advantage.

The Magic of Two Minds

Clients and allocators still make emotional decisions (they are people, after all). They may justify a choice with numbers, but they're moved to action by something less tangible: trust, belief, connection.

Two funds can have nearly identical five-year returns. One gets the allocation, the other doesn't. Why?

Because the winning firm told a story that resonated.

Most investment professionals are uncomfortable talking about their personal stories. They'd rather hide behind spreadsheets and performance attribution. But those personal stories are what create connections.

This is where creatives shine. We love to tell stories. It's kind of our thing.

The real magic happens when you marry two minds: the creative storyteller with the analytical, numbers-oriented professional who might be more reluctant to open up. One brings the data knowledge, the other brings the human connection. Together, they create something neither could achieve alone.

In meetings, you should be looking for ways to get the other person talking. While others might be focused on delivering their prepared remarks about alpha generation, I encourage you to ask questions that reveal what really matters to the allocator:

What keeps you up at night when you think about your portfolio?

Tell me about the best investment decision you've made recently.

What would success look like for you in this partnership?

The goal isn't to dominate the conversation. It's about understanding their viewpoint, pressures, and real needs.

When the decision maker does most of the talking, you learn what story they actually need to hear.

Generational Shift in Marketing

The industry sold "proprietary" and exclusivity for decades… and it worked. But allocators taking a fresh look want to know about the people behind the product.

This is true across industries, but the investment world still defaults to selling brand and safety.

Sometimes it works, but allocators can find safety in the connection that forms when they get to know the person.

Big firms are reluctant to sell the person because they fear having their investment managers gain too much influence. So they market generic videos and bland white papers in an effort to sell experience and expertise. This leaves room for boutiques.

From Spreadsheets to Stories

Finance is full of analytical brilliance. Smart people doing extraordinary work with numbers, strategy, and risk management. But brilliance alone doesn't guarantee buy-in.

A creative takes that brilliance and turns it into something people can feel. They pull the story out of the spreadsheets, connecting the dots between what the numbers say and why it matters.

For example, I want you to picture two boutique funds:

Fund A: Leads with charts, benchmarks, and bullet points. Rational. Logical. But rational doesn’t always win the human heart.

Fund B: Shares its origin story: the founder who left a cushy corner office to follow a conviction, the mentor who shaped the firm’s values, and the impact they’ve had on clients’ lives. The numbers are still there, but they’re grounded in purpose.

Fund B wins the allocation.

As I’ve said before:

Same data. Different delivery. One is a statistic. The other is a reason to believe.

Quick Wins

Even seasoned pros can begin telling better stories without sounding inauthentic:

Tie everyday experiences to the mindset needed to survive and thrive in the investment world

Share lessons learned from both successes and setbacks

Explain adjustments to either process or philosophy due to changes in the economy or markets

People Do Business With People

I’ve had the privilege of working with an industry leader as he builds his personal brand.

He’s a talented writer, but in the beginning, he was hesitant to post on Substack or LinkedIn. That fear is common in our world; putting yourself out there can feel risky.

Over time, he not only pushed past that reluctance, but he also reached the point where it feels strange not to share.

That shift from hesitation to authenticity is exactly what our industry needs more of.

The willingness to be human.

To tell the real story behind the expertise.

To connect on a level that goes beyond performance charts.

Because at the end of the day, people do business with people. And the firms that remember that will be the ones that thrive.

Want to dive deeper into storytelling & personal branding?